Choosing the right neighborhood in Dubai is very important when moving to a city so diverse and vibrant. Dubai offers a wide range of neighborhoods, each with its unique characteristics, amenities, and lifestyle options. This guide will help you navigate the various neighborhoods to find the one that best suits your needs and preferences.

Understanding Dubai’s Neighborhoods

Dubai is divided into several districts, each offering different living experiences and real estate options. From luxurious waterfront properties to family-friendly suburbs and bustling urban centers, Dubai has something for everyone. Understanding the layout and characteristics of each neighborhood is the first step.

Key Factors to Consider

When choosing the right neighborhood in Dubai, consider factors such as proximity to work, schools, amenities, transportation, and lifestyle preferences. Here are some key factors to help you make an informed decision.

Proximity to Work

Commute time can significantly impact your daily life. Choosing a neighborhood close to your workplace can save time and reduce stress. Popular business districts in Dubai include:

- Business Bay: A rapidly developing area with numerous office buildings, making it convenient for business professionals.

- Dubai Internet City: A hub for technology and media companies, perfect for those in the IT and digital media industries.

Schools and Education

If you have children, proximity to good schools is a crucial factor. Dubai offers a wide range of international schools following various curricula, including British, American, and IB programs. Neighborhoods with highly-rated schools include:

- Jumeirah: Home to several reputable international schools, ideal for families.

- Al Barsha: It offers a variety of schools and is close to the Mall of the Emirates.

Amenities to Support Your Lifestyle

When choosing the right neighborhood in Dubai, access to amenities like supermarkets, healthcare facilities, restaurants, nightlife, and recreational options plays a big role. Dubai is ranked among the top cities for a healthy lifestyle, making it easy to stay active and find nutritious food options no matter where you live. Neighborhoods such as Dubai Marina and Jumeirah Beach Residence (JBR) are especially popular for their wellness-friendly environments, with scenic running trails and fitness-focused communities. If you’re relocating to one of these areas to better align your surroundings with your lifestyle goals, it’s worth taking some time to prepare and get everything ready before the movers arrive, so you can settle in stress-free and start enjoying your new routine right away.

Popular Neighborhoods in Dubai

To help you get started, here are some popular neighborhoods in Dubai, each with unique appeal.

Downtown Dubai

Downtown Dubai is the heart of the city, known for iconic landmarks such as the Burj Khalifa, Dubai Mall, and Dubai Fountain. This area offers a mix of high-rise apartments and luxurious hotels. It’s ideal for professionals in the financial and corporate sectors and those who enjoy a vibrant urban lifestyle. The neighborhood is also home to various cultural and entertainment venues, including the Dubai Opera and numerous art galleries. Residents can enjoy an active social life with countless dining options, trendy cafes, and nightlife spots. Additionally, the area is well-connected by public transport, making it convenient for daily commuting.

Dubai Marina

Dubai Marina is a trendy waterfront community with high-rise apartments, luxury yachts, and a bustling promenade. It offers a lively nightlife scene, numerous dining options, and shopping destinations. The area is perfect for young professionals and expatriates looking for a vibrant, cosmopolitan environment.

Jumeirah

Jumeirah is a popular choice for families due to its proximity to excellent schools, parks, and beaches. This residential area offers a mix of villas and townhouses with easy access to amenities. Jumeirah is known for its relaxed, family-friendly atmosphere and beautiful beachfront properties. Residents also enjoy a variety of cafes, restaurants, and boutique shops. The neighborhood’s prime location along the coast makes it ideal for beach lovers and those who appreciate outdoor activities.

JLT

Jumeirah Lake Towers (JLT) is a vibrant and affordable Dubai neighborhood known for its scenic man-made lakes and high-rise towers. It offers a variety of housing options, making it popular among young professionals and families. Located along Sheikh Zayed Road and served by two metro stations, JLT provides easy access to the rest of the city. The area is self-sufficient, with numerous amenities, including supermarkets, restaurants, gyms, and parks. JLT is also a business hub with many offices and coworking spaces, attracting entrepreneurs and businesses.

Business Bay

Business Bay is a rapidly developing commercial district with numerous office buildings, hotels, and residential towers. It offers easy access to Downtown Dubai and is suitable for business professionals seeking proximity to their workplace. The area also features trendy cafes, restaurants, and a vibrant nightlife. Business Bay’s strategic location near major highways and public transport hubs makes commuting easy.

Al Barsha

Al Barsha is another affordable neighborhood that offers a mix of villas and apartment buildings. It is home to the famous Mall of the Emirates and provides easy access to Sheikh Zayed Road and Al Khail Road. The area is popular among families due to its range of schools, parks, and healthcare facilities. Al Barsha also claims numerous dining and shopping options, making it a convenient and well-rounded place to live.

Palm Jumeirah

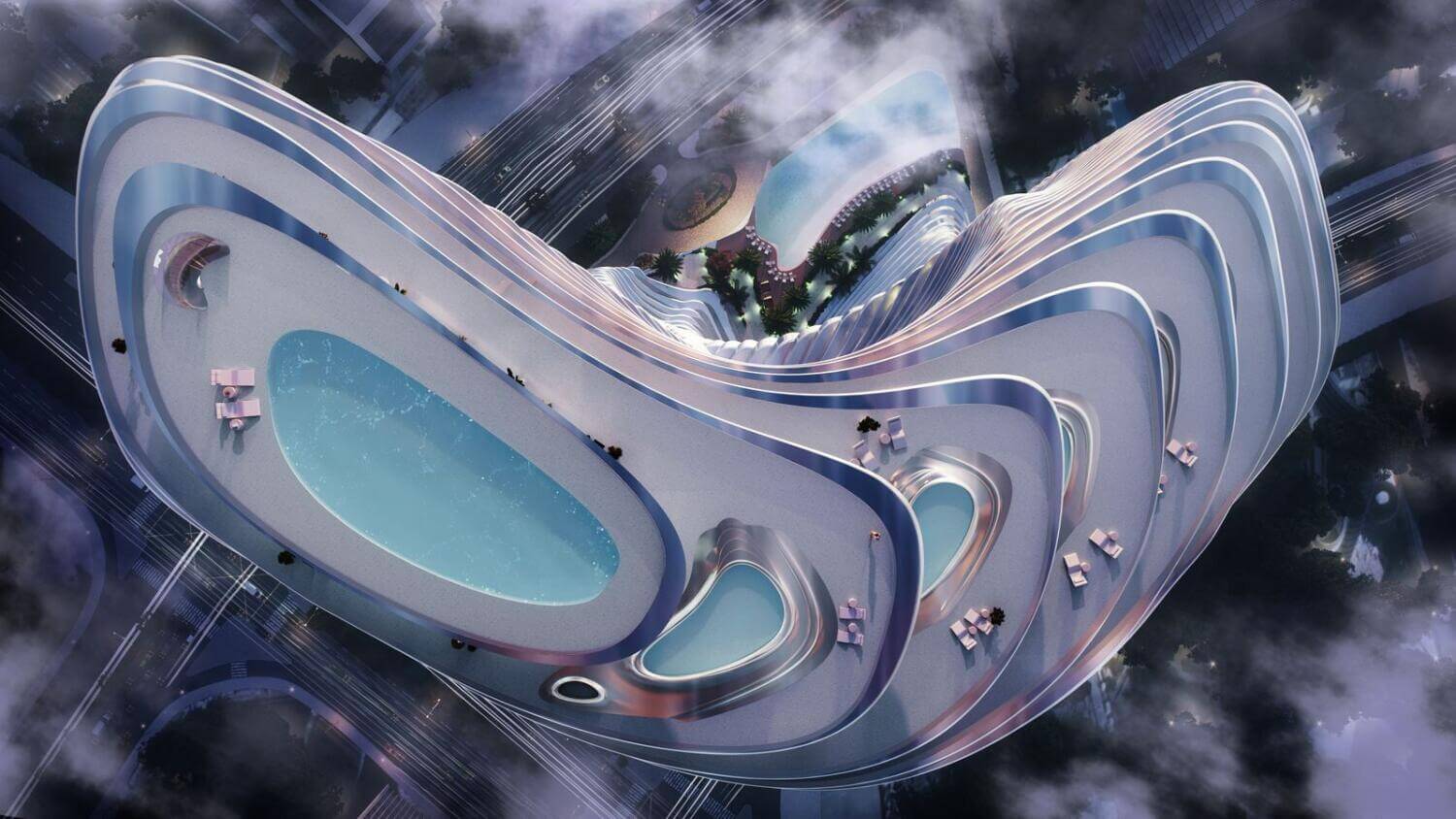

Palm Jumeirah is an iconic man-made island known for its luxurious villas, high-end apartments, and stunning beachfront views. It offers a lavish lifestyle with access to private beaches, five-star hotels, and upscale dining options. Palm Jumeirah is perfect for those seeking a prestigious address and exclusive living. The island’s unique design provides residents with spectacular sea views and easy access to water sports. High-end retail outlets and leisure facilities ensure that residents have everything they need within a short distance from their homes.

Final Tips for Choosing the Right Neighborhood in Dubai

When choosing the right neighborhood in Dubai, visiting the areas you’re considering is helpful. Take the time to explore the neighborhoods, check out the amenities, and get a feel for the community. Speaking with residents can provide valuable insights into what it’s like to live there.

Likewise, consider your long-term plans. If you plan to stay in Dubai for an extended period, choosing a neighborhood that can accommodate your future needs is important. For example, if you plan to start a family, ensure the area has good schools and family-friendly amenities.

Final Thoughts

When relocating, choosing the right neighborhood in Dubai involves carefully considering various factors such as proximity to work, schools, amenities, transportation, and lifestyle preferences. By understanding the unique characteristics of each neighborhood and evaluating your needs, you can find the perfect area to call home in this vibrant city. Whether you prefer the bustling urban life of Downtown Dubai, the waterfront luxury of Palm Jumeirah, or the family-friendly atmosphere of Jumeirah, Dubai offers a neighborhood that will suit your lifestyle.